The growth in electric vehicles and the electrification of our transportation sector will bring a multitude of business opportunities. In this edition of DNV GL’s Retail Market Monitor, we explore the projected growth of electric vehicles in North America, the various business models of electric vehicle energy supply and associated charging infrastructure, recent M&A activity, regulatory approaches, current retail energy strategies being deployed, and approaches to evaluating emerging electric vehicle strategies.

Electric Vehicle Growth

The electrification of the global transportation sector is well underway with increasing adoption of battery electric vehicles (BEV) in both light passenger vehicles and commercial fleets. Significant growth in North America is forecasted as electric vehicle costs decline and achieve price parity with internal combustion engine vehicles (ICEV) soon. With a total of more than 40 models available from most major car manufacturers, all-electric and electric hybrid options have expanded to meet a wider variety of driving needs. The availability of car charging, including rapid charging, is also expanding quickly.

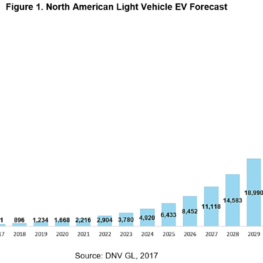

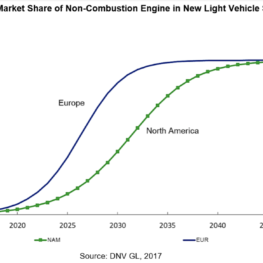

The uptake of EVs will follow an S-shaped curve, reflecting the adoption of new products and technology described by the Bass Diffusion Model. Digital cameras, and mobile phones are two recent examples of Sshaped market growth. In the case of EVs, the steepness of the S-curve will be determined by access to charging infrastructure. DNV GL forecasts that the share of new light electric vehicles in North America will exceed 25% by 2028 and 50% by 2032.

The market share of heavy duty vehicles is expected to come about more slowly, not even reaching a 10% share of new vehicles sold until after 2040. However, additional investment in EVs by large fleet operators could cause the adoption rate to accelerate because the early results of fleet conversion have been significant. Earlier in 2018, UPS announced plans to deploy 50 all-electric delivery trucks citing that the acquisition costs are now in-line with conventionally-fueled trucks even without any tax subsidies. UPS also points to a 400% fuel efficiency improvement for trucks that have a range of approximately 100 miles between charges. The 50 all-electric trucks are a small blip among the 35,000 diesel or gasoline delivery trucks in the UPS fleet but the results have been encouraging. UPS has also ordered 125 new TESLA semitractors which will be built in 2019. TESLA semi-trucks are expected to have a 300-500-mile range depending upon model and cost $200,000.